[ad_1]

I admit it: I wasn’t always the best at teaching my kids about money. My youngest definitely got a better education than my oldest, because I had more practice at teaching by then. However, after lots of research, today I have a great grasp on how to teach kids about money – and you can, too!

Teaching your children about financial issues just makes good sense, and the time spent doing it is a solid investment in their future. When kids grow up learning about money, they have a far greater chance of making sound financial decisions as adults.

For the most part, teaching kids about finance is a task left up to parents. Unfortunately, it’s a confusing subject that most parents aren’t quite sure how to teach. How early should you start? What’s appropriate for each age? Are there any tools, apps, or other resources out there that can help you?

Your complete guide on how to teach kids money skills starts right now.

1. Toddlers/Preschool

I was surprised to learn how early kids can absorb lessons about money. You can start teaching the basics before kids even start preschool. Kids as young as three understand simple concepts about money.

Focus on the following key financial concepts for a toddler/preschooler:

- Saving paper money and coins in a physical container

- Understanding money as a way to get items

- Understanding what belongs to them and what belongs to others

Keep those concepts in mind as you teach your child during these years.

Pay Attention to the Example You Set

You don’t need me to tell you that kids notice everything. As my grandma would say, “Little pitchers have big ears.” Before your little ones understand the concept of money, they’ll formulate emotions about it based on your actions.

Even when money is tight, avoid showing money-related stress around your child as much as possible. You don’t want young children to associate the idea of money with the emotion of fear or anger.

At the same time, you don’t want to spend money with reckless abandon in front of your child, as that can reinforce an irresponsible attitude about money’s value.

Should You Give Toddlers an Allowance?

The issue of whether or not to give a toddler or preschooler an allowance doesn’t have a clear answer. By the age of seven, kids can understand basic money concepts, so a simple allowance does have educational benefits.

I’ll cover how to calculate a child’s allowance, and how they should earn it, a bit further below when talking about elementary and middle-school kids. For now, we’ll just assume your kids are receiving small amounts of money on at least a semi-regular basis (either an allowance or gifts).

Choose a Clear Piggy Bank

When I was a kid, I had a pink, ceramic piggy bank that I dutifully filled with quarters and dimes. While there’s nothing wrong with a classic, many experts today say that a clear container is the best way to teach kids about money.

A clear jar lets kids watch their money grow. It helps clarify the sometimes-confusing concept of saving. You want to reinforce their saving habits by cheering them on and pointing out the progress they make.

Use a clear jar that’s small enough so that each deposit shows noticeable growth. However, the jar should also be large enough that filling it feels like an accomplishment.

You can tie the filling of the jar with a tangible item the child wants to purchase, such as a toy. If you choose to do this, decorating the jar with pictures of the item helps reinforce the idea of a goal.

Highlight the Concept of Exchange

You want to introduce the idea that money is exchanged for items. It’s a difficult concept for kids to grasp by hearing. However, they often understand the idea through action.

When they’ve reached their savings goal, and it’s time to buy their desired item, you want them to make the purchase themself. While you can help, you want them to do as much as possible, including:

- Selecting the item from the shelf

- Carrying it to the register

- Handing the money to the clerk

- Accepting change

The physical action of handing money (not a credit card) over to a cashier, and receiving an item in return, helps explain what money is, and what it does, in a way that a small child can easily understand.

Family Budgeting

You don’t need to dive too deep into family finances at this age. Stick to the basics, such as mom and dad go to work to earn money. Then, they spend that money on things like our home, food, clothes, and other items needed as a family.

Introduce the Concept of Giving

Allow your kids to watch you donate to charity, such as by writing a check or donating through a website. Young kids won’t understand every aspect of what’s going on, but you can use the process to talk about the importance of helping others and what your donation does (in general, kid-friendly terms, of course).

Receiving Money as Gifts

As kids start to enter elementary school, they’ll typically start to receive pocket money as gifts, often from family members. They might get a few bucks here and there from grandpa or larger amounts for birthdays and holidays.

You want to teach them how to graciously receive money. When I was a kid, my parents had two rules about how to thank someone for a monetary gift. I had to write the person a handwritten thank you note. Also, I had to tell the person that I planned to save some of the money.

Apps and Games Suitable for Toddlers and Preschoolers

You can find a variety of games to help teach money management to this age group. Games are only a supplement; they can’t replace the effectiveness of your child making a real purchase in a store.

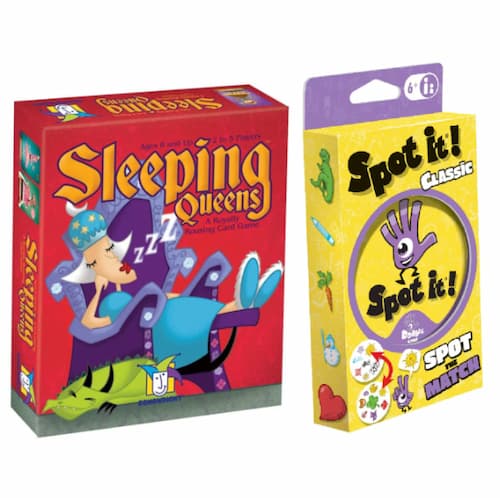

Here are a few I recommend:

- Peter Pig’s Money Counter – Kids learn counting basics and fun, kid-friendly facts about currency.

- Wise Pockets – These interactive stories from the University of Missouri help teach about learning, saving, borrowing, and lending.

You want relatively simple games with bright colors and cheerful characters that appeal to kids.

2. School Age

Here, we’re talking about elementary and middle-school aged students. With school-age children, you want to focus on the following concepts:

- The different values of coins and paper bills

- The idea that different things cost a different amount of money

- How to identify the total cost of an item

- How to count change

- The idea of earning money with an allowance

Considering “school age” is a fairly wide age range, you want to introduce simpler concepts early on and then develop them over the years.

Start an Allowance

Every expert I’ve read has been in favor of giving an allowance. They’re considered an important tool in developing financial literacy. However, the details vary considerably. How much should you give? What should you give an allowance for?

I’m here to tell you, mom to mom, that ultimately just trust your gut. Give your child the type of allowance you think is appropriate for your household.

Connecting the allowance to household chores is pretty popular among parents. It has three benefits for kids in this age range:

- They learn how to appreciate the work necessary to earn money

- They learn to feel pride from accomplishing tasks

- The habit of completing chores typically extends into adulthood

Don’t just give kids an allowance for existing, as that can turn them into adults who take money for granted. Some parents don’t like the idea of paying their kids for daily household chores. Instead, they prefer that kids earn money by extras, such as weekly mowing, driveway shoveling, or other as-needed tasks.

Teach the Concept of Opportunity Cost

Opportunity cost is the idea that when you spend your money in one way, you’re limiting your ability to spend it in other ways. For instance: “If you buy a game for your Switch, you won’t have enough money to buy new skateboard wheels.” As kids mature, they’re more able to weigh the benefits of different spending decisions and how their long-term goals could be affected.

Curb Impulse Shopping

School-age kids struggle to plan for the future. They’ll often fall in love with an article of clothing, toy, or another item they simply can’t live without.

You want to discourage impulse buys. First, don’t give in and buy the item for your child. Instead, make them spend their own money on “Mom I gotta have it now” items.

Next, encourage your child to sleep on it. Reassure your child that the item won’t disappear from stores overnight. By waiting a day, kids help develop their understanding of opportunity cost. If they still want to buy the item, they’re far less likely to regret the purchase later.

Increase Lessons on Charity

While toddlers and preschoolers only watched you participate in charitable giving, elementary and middle school kids are ready to donate some of their own money. Allowing them to choose their own charity typically increases their level of interest.

They don’t have to give an extraordinary amount. Small, consistent amounts help them continue the habit into adulthood. Plus, you can introduce the idea of giving in other ways, such as donating time to help with charitable projects.

Family Budgeting

During school years, you can further explore the concept of basic family budgeting. While you don’t need to disclose exactly how much mommy and daddy make each year, you do want to discuss various household budgetary concepts.

Basically, you’re applying the lessons of Opportunity Cost to the entire family. For example, explain that we’re driving on vacation this year instead of flying because it’s cheaper and helps us save money. You can also introduce the idea of monthly budgeting, where the entire family has to earn more than they spend as a group.

Apps and Games

The US Mint has tons of games designed for school ages kids – and they’re surprisingly great. Who knew the US Mint was so much fun? Most games involve a variety of fun facts about coins. Parents and teachers can also find helpful lesson plans.

3. Teens

Teens are ready to handle a variety of fairly sophisticated issues related to finance. While expanding your teen’s financial freedom can feel frightening, keep in mind it’s far better for them to make mistakes now than after they’ve left the nest.

Teens Can Have a Bank Account

Most teens are responsible enough to have a simple checking account and debit card. Many banks offer options where you can monitor your child’s account activity. Connecting your account to your child’s can help them build good credit.

Additionally, you might want to consider turning off overdraft protection for your child. If they attempt to spend more than they have, the transaction will get denied. That helps prevent bank fees from appearing, which can pile up quickly.

Let your teen choose a bank they feel comfortable with. Far more than adults, teens live in a world increasingly dominated by online banking. They’ll want a bank with an online system that is easy to navigate.

Help Them Earn Money

Although your teens might feel otherwise, the high school years are often a great time to earn money. Teens don’t need a career. Instead, short-term jobs during summer, winter, spring, and fall break provide excellent opportunities for making money.

Keep an eye out for non-traditional jobs. Making money online through YouTube or Twitch is an increasingly viable option. Of course, you’ll need to do your own research. Don’t just take your teen’s word for it that they’re the next big YouTube star, for example. Still, don’t dismiss these online entrepreneurial efforts outright.

Start Saving for College

Here’s where the lessons learned from the clear piggy bank hopefully start to pay off. The teenage years are a great time to start saving for college. If they’re working a part-time job, you want them to save a portion of each paycheck.

Set your teen up with a separate savings account. Like the clear piggy bank, you want your child to easily view the account, so they can watch their balance grow.

Investing

Saving for college is also a great opportunity to introduce various investing concepts. You and your teen can work together to identify the smart place to invest their college money. Encourage your teen to explore the idea of investing by asking questions such as the following:

- What types of accounts offer interest?

- How long will you save this money until you’ll need it?

- How much money will you need for college?

At this stage, it might not be a bad idea to include some information about the overall family budget. How much (if anything) are you planning to contribute towards your teen’s college education? What stipulation must be met by your teen in order to receive this contribution?

Should Your Teen Take Out Student Loans?

You’ll find plenty of financial experts that tell you to never, under any circumstances, have your teen take out student loans. Now, I’m just a mom, but I’m hesitant to say it’s never a good idea. However, I definitely recommend a thorough consideration of all the available alternatives, including:

- Community college

- Trade school

- Working while attending college (even if it takes longer to graduate)

- Scholarships

If you’ve considered all the options and still think student loans are the best option, you want to help them every step of the way. While teens are old enough to understand many financial concepts, they’re still too young to commit to a lifetime of loan payments, so you’ll want to supervise their decisions.

Apps and Games

You’ll find a variety of games appropriate for this age range. Some that I recommend include:

- The Stock Market Game – Created by SIFMA, a financial education organization, this comprehensive game touches on practically every aspect of the stock market

- Financial Football – Sports fans will love this game that teaches financial concepts in a football format.

While games can play an important role in building financial skills, they’re not quite as important at this age compared to the earlier stages. Instead, teens can concentrate on real-world uses of money.

Should My Teen Know How to Write a Check?

As I touched on earlier, teens today live in an entirely different financial world than the one you and I likely grew up with. Basically, all banking is done online. The days of writing checks are over, aren’t they?

Not entirely. Your teen will still probably need to write a check or two. Many landlords require checks for rent, or at least for the security deposit.

Many checking accounts include at least one free booklet of checks. Teach your teen how to write a check. Even if it’s not a skill they’ll use every day, it’s still useful to know.

Final Thoughts on Raising Money-Smart Kids

When you teach kids about money and demonstrate good spending habits, you’re setting them up for a lifetime of financial success. In a way, these small, simple lessons taught early in life are no different from compound interest. As your child matures, he or she will reap the dividends by understanding how to save comfortably, spend wisely, and give charitably.

— By Nelle Bligan

[ad_2]

Source link